Finding the Best Platform for CFD Trading

In the dynamic world of financial trading, choosing the right platform can significantly impact your trading experience. Whether you’re a novice trader looking to start your journey or an experienced trader seeking advanced tools, identifying the best platform for CFD trading is essential. In this article, we will explore various aspects to consider when choosing a CFD trading platform, with references to best platform for cfd trading CFD brokers for indian traders.

Understanding CFD Trading

Contracts for Difference (CFDs) are financial derivatives that provide traders with an opportunity to speculate on the price movements of various assets, including stocks, currencies, indices, and commodities. Unlike traditional trading, where you own the underlying asset, CFD trading allows you to trade on margin, amplifying both potential profits and risks. The popularity of CFDs continues to surge due to their flexibility and accessibility.

Key Features to Look for in a CFD Trading Platform

When evaluating a CFD trading platform, several features warrant your attention. These include:

- User-Friendly Interface: An intuitive platform facilitates seamless navigation and enhances the trading experience, particularly for beginners.

- Variety of Trading Instruments: A good platform should offer a wide range of CFD instruments to trading options across different markets.

- Regulation and Trustworthiness: Ensure that the provider is regulated by recognized authorities, providing you with security and transparency.

- Low Spreads and Fees: Competitive spreads are crucial as they directly affect your profitability. Compare different platforms to find the best fee structure.

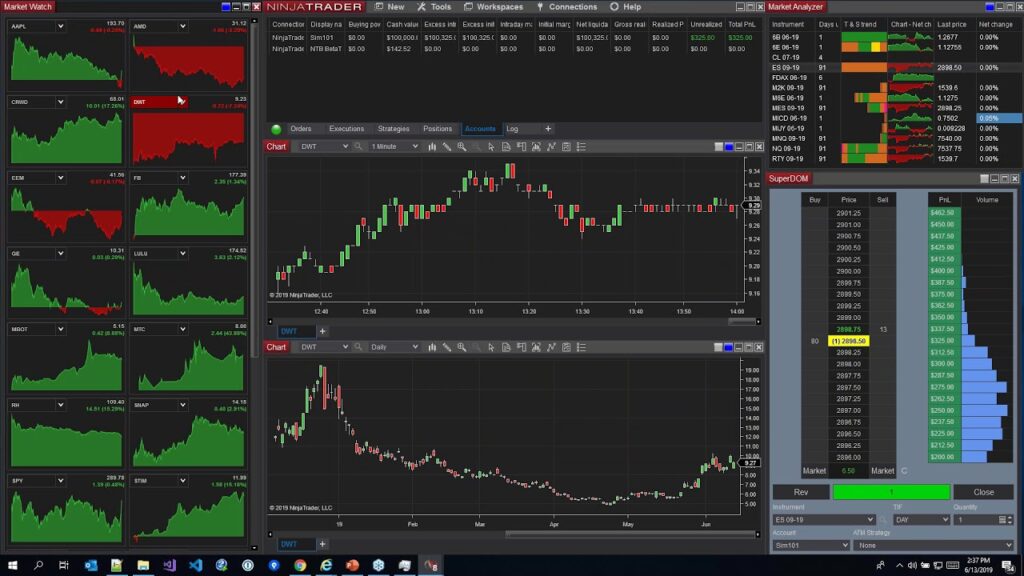

- Trading Tools: Advanced analytical tools, charts, and indicators help traders make informed decisions.

- Customer Support: Responsive and knowledgeable support can be vital for resolving issues quickly.

- Mobile Compatibility: A mobile app allows you to trade on the go, ensuring you never miss an opportunity.

Analyzing Popular CFD Trading Platforms

Several platforms have become prominent in the CFD trading space. Here, we’ll look at a few of the best-known platforms, highlighting their unique offerings.

1. MetaTrader 4 (MT4)

MetaTrader 4 is one of the most popular trading platforms globally, favored for its user-friendly interface and robust analytical tools. Its extensive charting capabilities, automated trading options, and the ability to access various CFDs make it a top choice for many traders. Additionally, MT4 supports mobile trading, enabling users to stay connected to the market.

2. eToro

eToro stands out for its social trading features, allowing users to copy the trades of successful investors automatically. This platform is ideal for beginners looking to learn from experienced traders. eToro also offers a diverse range of CFDs on various assets, alongside a user-friendly interface and educational resources.

3. IG Group

IG Group is a well-established CFD trading platform distinguished by its extensive product range and advanced charting tools. IG provides excellent research and analysis features, making it suitable for serious traders who focus on strategy and in-depth analysis. Their platform is not only user-friendly but also packed with sophisticated trading tools.

4. Plus500

Plus500 is known for its transparent pricing model and no commissions on trading. The platform offers a wide variety of CFDs and an easy-to-use interface, making it an appealing option for traders of all levels. Additionally, Plus500 provides a demo account for users to practice before committing real funds, which is a significant advantage for beginners.

Benefits of CFD Trading

Trading CFDs offers several benefits that continue to attract traders worldwide:

- Leverage: Traders can control a larger position size with a smaller capital outlay due to leverage, amplifying potential returns.

- Flexibility: CFD trading allows speculation on rising and falling prices, providing opportunities to profit in various market conditions.

- Diverse Markets: CFDs allow access to various markets without the need to invest in physical assets.

- No Stamp Duty: In many jurisdictions, CFD trading does not incur stamp duty, which can lead to cost savings for traders.

Risks of CFD Trading

Despite the benefits, CFD trading comes with inherent risks. Significant points to consider include:

- Leverage Risks: While leverage can magnify gains, it can also lead to substantial losses if the market moves against your position.

- Market Volatility: Sudden market swings can impact CFD prices, leading to potential losses.

- Overtrading: The ease of access can lead traders to take excessive risks, resulting in significant financial losses.

Tips for Successful CFD Trading

Leveraging CFD trading to your advantage requires a strategic approach. Here are some tips to consider:

- Educate Yourself: Familiarize yourself with market dynamics, trading strategies, and the specific platform you choose.

- Start with a Demo Account: Use a demo account to practice trading without risking real money, helping you to build confidence and test strategies.

- Manage Your Risk: Employ risk management techniques such as stop-loss orders and not risking more than a small percentage of your capital on a single trade.

- Stay Informed: Keep track of market news and trends that can influence asset prices and CFD markets.

- Keep a Trading Journal: Document your trades and strategies to review your performance and learn from your experiences.

Conclusion

Finding the best platform for CFD trading involves understanding your trading needs and carefully evaluating your options. By focusing on essential features, reviewing popular platforms, and implementing effective trading strategies, you can enhance your trading experience significantly. Whether you’re interested in the CFD brokers for Indian traders or exploring options globally, continue to educate yourself and adapt to market changes to thrive in the world of CFD trading.

Recent Comments