Tier-2 regulators such as DFSA, FMA, and you may FSCA common within the shorter or emerging segments, give a reasonable amount of individual security with a few enforcement away from working legislation and you may consumer money protection. Tier-step one government such as the British FCA, IIROC, CySEC, and you can ASIC need legally independent client money from their and you may give negative harmony shelter to keep membership out of shedding for the deficit. Such regulators also require agents to become listed on a compensation scheme, and that protects customer assets if your agent happens bankrupt. To verify a broker’s regulatory adherence, opinion the court terms and look on the related nation’s regulatory sign in.

Best Metals Change Forex Agents to have 2025

When you are searching for exchange XAUUSD, you can consider our best change brokers to have certain https://forexedge.net/en/ options. Risk crypto, earn rewards and you will securely manage three hundred+ assets—all-in-one top platform. That have a major international method, Duhani Money welcomes numerous types of dumps. Users have the choice out of bank transfers, e-purses, debit/playing cards, and also crypto. A straightforward QR code choice in addition to allows buyers to help you go without remembering cutting-edge financial information and simply examine the fresh password to own instant places.

Interactive Brokers – Sophisticated Platform To Exchange Precious metals

Moneta Locations is promoting its very own copy trade app, enabling signal team and you may followers for connecting and you will show change signals and facts seamlessly.

Costs performance is trick; we selected agents that have tight advances to reduce change can cost you. We reviewed exchange app, prioritizing platforms that have advanced charting, varied buy types, user-friendly interfaces, and you may automatic trade has. As well, we sensed the most leverage for each and every agent offers to own commodities, providing to different risk preferences and methods. The bottom line is, XAUUSD is not just an icon on the price of gold within the U.S. cash plus a representation of wide economic manner and you can industry sentiments. The lasting interest because the a safe-sanctuary resource means it will remain a key component out of economic areas for a long time.

Simultaneously, Exness imposes zero leverage restrictions for profile having web security below $1,000, allowing speculative people to select control accounts that fit their actions. This information considering a comprehensive inclusion to the some material icons from the foreign exchange market and you can checked tips exchange these gold and silver coins and you will add these to change networks such MetaTrader 4. Familiarity with such rules support investors generate much more advised exchange conclusion and take benefit of the newest possibilities found in the fresh gold and silver field. Scientific improvements and also the development from on line exchange programs has facilitated access to the new gold market for traders.

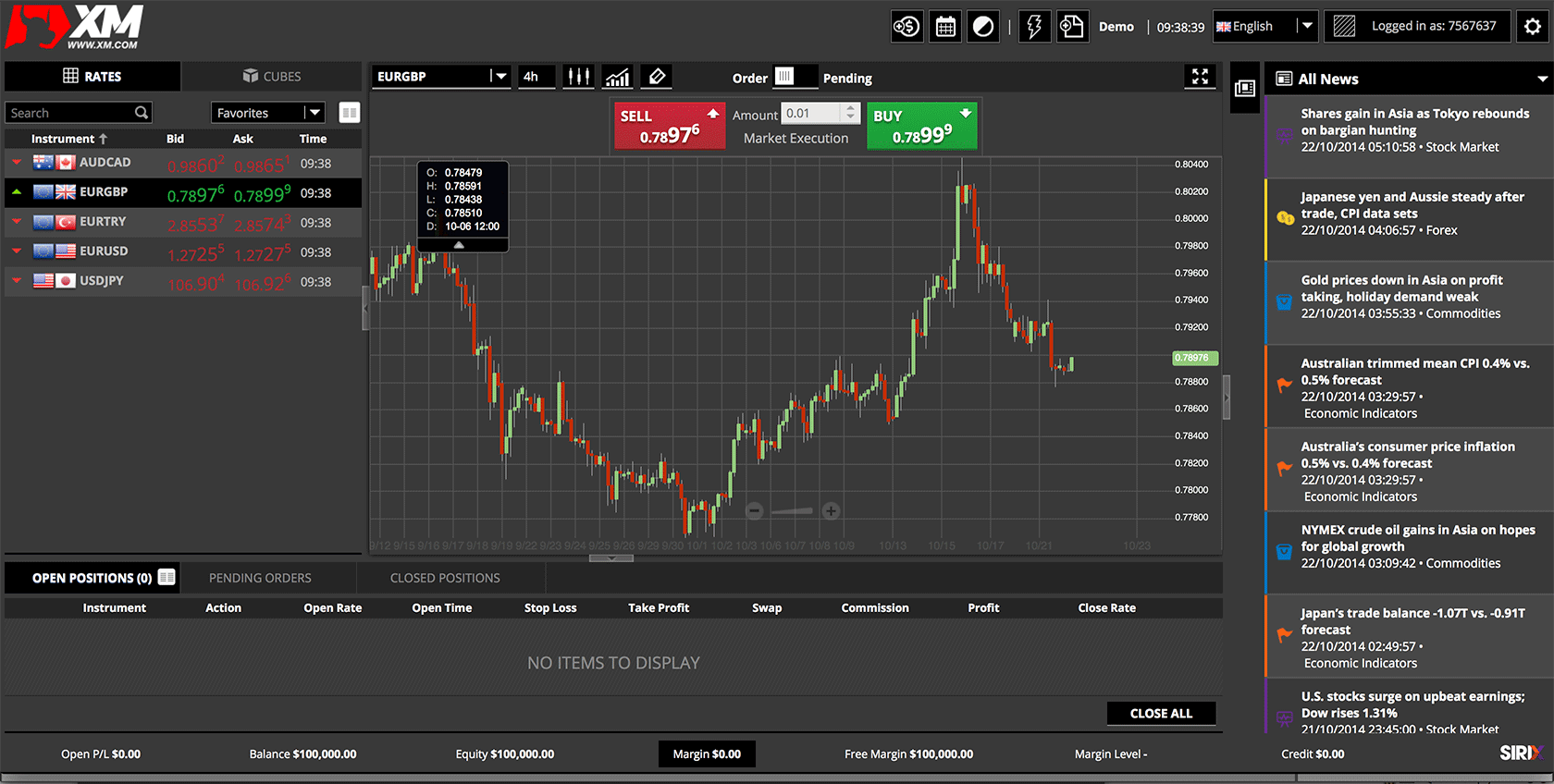

Trade gold regarding the foreign exchange market is completed electronically as a result of fx agents. The cost of gold is decided in the actual-time according to likewise have and you will demand. Traders may use trade programs to find (go long) otherwise sell (go small) silver.

- Yet not, the newest agent tend to usually mark up the fresh pass on it discover away from the new interbank market to make up on their own.

- Buyers usually explore hedging to attenuate losings while in the erratic market criteria.

- Trading location precious metals is much like currency trading in which traders take small or enough time ranks to the gold and silver coins’ costs.

- Duhani Money have a tendency to twice its customer service team from the future 12 months, bringing unparalleled features rather than diminishing the fresh core belief of reduced-prices exchange for all.

- The brand new platform’s global customer base can also be trading the offered gold and silver coins 23 instances everyday.

Whenever people buy spot metals, he or she is essentially investing a location steel to have a good money. Silver is one of preferred commodity providing large liquidity and you will trading it as a result of CFDs enables significant power and you may counted risk. Precious metal, palladium and silver also are crucial with their industrial apps in addition to their use in the brand new design away from accessories.

Hold change is designed to take advantage of currency interest differences in the fresh futures industry. Investors often fool around with hedging to reduce loss throughout the unpredictable industry conditions. You can use futures or choices agreements to do this within the steel exchange. Such as, for those who keep silver ranks, you can get lay possibilities or sell futures agreements to ensure you do not remove extreme profits while the gold cost abruptly plummet.

Recent Comments